wells fargo class action lawsuit fake accounts

If you were Wells Fargo customer or Wells Fargo employee and were involved in the fake account crisis that was recently reported in the news please contact us. The lawsuit was filed in the US.

Los Angeles Sues Wells Fargo Over Fraudulent Conduct In Face Of Sales Pressure Los Angeles The Guardian

Wells Fargo closed fraud victims accounts without investigating a potential crime as required by law a new whistle-blower lawsuit claims.

. On top of that two former Wells Fargo employees are seeking 26 billion for current and former bank employees who were punished because they didnt meet Wells Fargos unrealistic quotas The suit is claiming that the bank promoted employees who made their quotas by setting up fake accounts while those who didnt take part were demoted or fired. Filed a class action lawsuit against Wells Fargo alleging the bank victimized its customers by using illegal fraudulent and deceptive tactics to boost sales of its banking and financial products. The class action lawsuit Jabbari v.

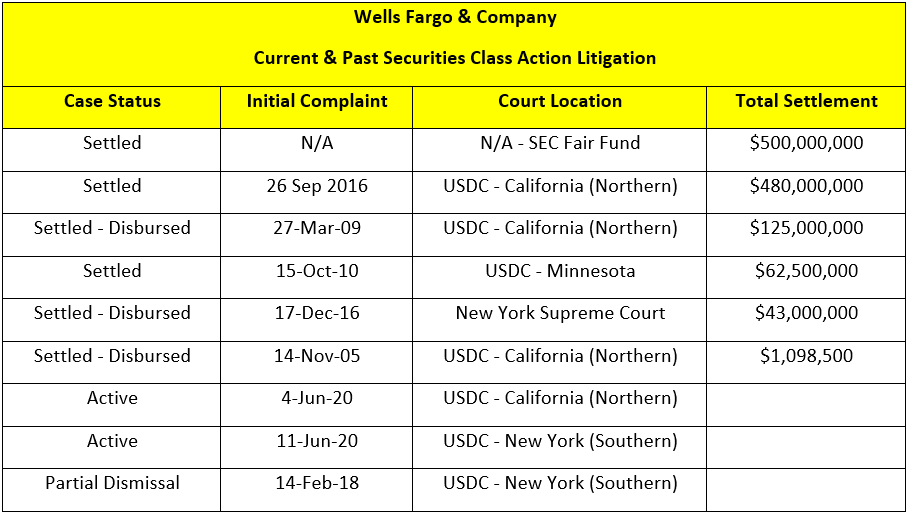

Wells Fargo has reached a 3 billion settlement with federal regulators over its creation of fake accounts in 2016. Wells Fargo Co embroiled in a scandal over the opening of sham accounts was sued on Friday by customers who accused the bank of fraud and recklessness for its behavior. In 2018 one class action settlement did resolve some claims against Wells Fargo in relation to its fake accounts scandal.

Wells Fargo agreed to settle a class action lawsuit concerning its fraudulent behavior in opening millions of checking savings and credit card accounts in the names of customers who did not authorize them. Wells Fargo Customers and Employee Class Action Investigation. August 8 2018.

The Wells Fargo Settlements Timeline. In the settlement Wells Fargo agreed to pay 142 million to consumers who had an unauthorized account opened in their name between May 1. Wells Fargo is currently facing -- and trying to get out of -- a dozen class action lawsuits involving a fake account fiasco that saw bank employees opening millions of.

Wells Fargo may be sounding a more friendly tone these days but the big bank is still playing legal hard ball with victims in the fake account scandal. The fraud started to gain wider attention in 2016 when a group of government regulatory agencies fined the company a combined 185 million. The fake accounts scandal centered around employees of the bank that were opening unauthorized additional credit card and bank accounts for current customers of the financial institution.

Wells Fargo Co is pending in federal court in San Francisco. On May 13 2015 Keller Rohrback LLP. In addition to paying out a portion of the claims Wells Fargo will also cover legal costs which total 365 million.

28th of March 2017 Wells Fargo agreed to shell out 110 million as a class action settlement for the class action lawsuits that accused them of registering customers for accounts they didnt consent to and never knew about. Additionally these same employees also signed patrons up for. District Court in Utah and seeks class-action status on behalf of hundreds of thousands of customers nationwide.

Wells Fargo agreed Friday to pay 3. The judge in that case ultimately denied Wells Fargos motion to compel the plaintiffs to pursue their claims through. Fill out the form on this page or call.

Wells Fargo customers have opened a class. The proposed class action suit accuses Wells Fargo of fraud invasion of privacy and breach of contract for opening fake accounts under customers names. Wells Fargo subsequently dealt with civil and criminal.

Christopher DiltsBloomberg News Article. In 2016 and 2017 the Wells Fargo fake accounts scandal made headlines across the country. While it has been reported that some lenders have refused to approve Black applicants the class action lawsuit against Wells Fargo has been filed in the Northern District of California.

Wells Fargo has continued to seek to enforce the forced arbitration clauses in other pending litigation arising from its fake accounts scandal including a class action lawsuit brought in a federal district court in Utah. The bank later paid 110 million to.

Fired Wells Fargo Workers File Federal Class Action Lawsuit Seeking 7 2 Billion Wells Fargo Fargo Bank Branch

The Wells Fargo Scandal A Simple Overview Youtube

Investors Closer To 500 Million Payout From Wells Fargo Settlement

28m Wells Fargo Settlement Resolves Call Recording Claims Top Class Actions

Wells Fargo Fake Account Lawsuit Settles For 110 Million Fortune

Wells Fargo To Pay 575m Settlement For Setting Up Fake Banking Accounts Us News The Guardian

Wells Fargo Unauthorized Accounts Class Action Settlement Top Class Actions

Wells Fargo Forced To Pay 3 Billion For The Bank S Fake Account Scandal

Wells Fargo Facing Class Action Over Zelle Scams Pymnts Com

Wells Fargo Reaches 3 Billion Settlement Over Fake Accounts Scandal The Washington Post

Wells Fargo Class Action Says Company Faked Diversity Efforts When Hiring Top Class Actions

How To Get Your Piece Of The Wells Fargo Banking Scandal Settlement

Wells Fargo Says 3 5 Million Accounts Involved In Scandal Ctv News

Wells Fargo To Pay 3 Billion Over Fake Account Scandal

Wells Fargo To Pay 3 Billion Over Fake Account Scandal

Wells Fargo S Collapsing Corporate Values Lead To Fraud Mei Qing Maxine Chen S Blog

Wells Fargo Settles 480m Class Action Brought By Investors Philadelphia Business Journal

Wells Fargo Faces 3b Fine Over Fake Accounts Top Class Actions

Wells Fargo To Pay 3 Billion To Doj Sec To Resolve Criminal Civil Charges Tied To Fake Accounts Scandal Cfcs Association Of Certified Financial Crime Specialists